Real Estate Editorial

When is it Safe for Me to Upgrade?

Deciding to upgrade your home is a big step. Maybe you've spent the last five to eight years in the same place, and you're starting to wonder if it's time for a change. It's a decision that many homeowners face at some point.

Often, people turn to real estate agents for advice, which can be a bit like asking a car salesman if you need a new car. Their answers might not always match your best interests.

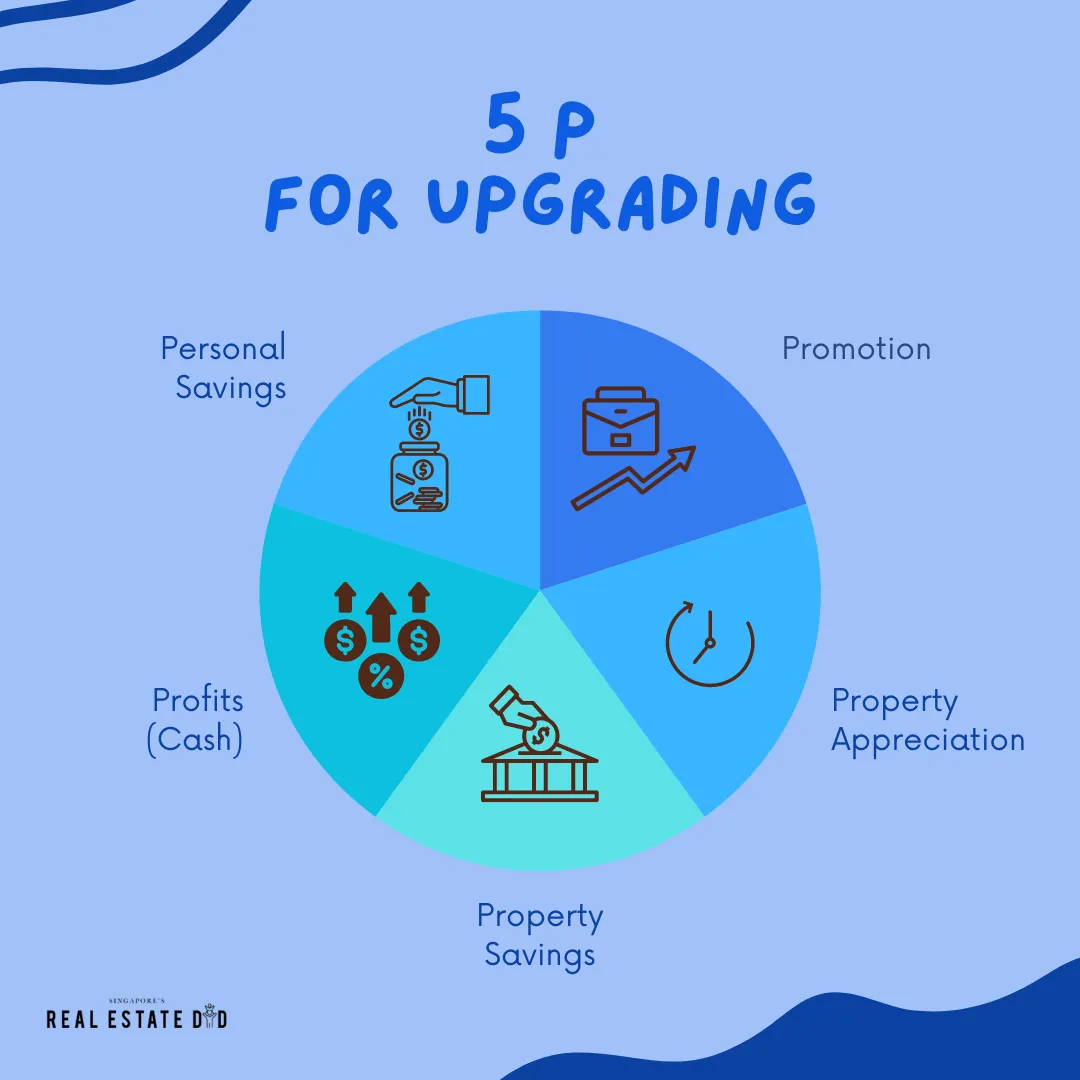

In this article, I will be sharing with you this concept called the 5 Ps. With this you are equipped to make a decision that's not just based on a gut feeling or someone else's advice but based on your own personal and financial situation.

Whether you're dreaming of a bigger space, a better location, or a more luxurious setting, this concept will provide a clear path forward.

Promotion

Let's start with promotion. This aspect involves evaluating your job/career progression. An increase in salary means that banks might grant you a larger loan.

However, a higher salary doesn't mean you should automatically upgrade. A bigger loan also translates to higher monthly repayments. You can estimate your monthly mortgage using a mortgage calculator.

It is also important to consider the stability and longevity of your new income level. Financial experts often advise that you should experience consistent earnings at your new salary level for at least 6-12 months before committing to larger financial obligations. This approach ensures that your upgrade is sustainable and doesn't put undue strain on your finances.

The other thing is a promotion often comes with increased responsibilities and, possibly, longer working hours. It is important to weigh these factors against the benefits of a larger or more luxurious home. Will your new responsibilities allow you the time and energy to enjoy your upgraded home? Or will the demands of your job overshadow the lifestyle improvements that come with a better property?

Property Appreciation

Now let's talk about the second "P" - Property Appreciation. This is about seeing how much the value of your current home has gone up. Knowing this can help you decide if it's a good time to upgrade.

Property appreciation means your house is worth more now than when you bought it. For example, if you bought your home for $400,000 and it's now worth $500,000, it has appreciated by $100,000.

You can check websites like hdb.gov.sg or ura.gov.sg to see recent selling prices in your area. You can click here to get an estimate of what your home might be worth today.

Property Savings

Property savings refer to the principal amount accumulated over the years from paying down your mortgage. However, an installment consists of two parts: principal and interest. The interest is what you pay the bank for the loan service. The principal goes towards repaying the original loan amount. When you sell, the principal paid is returned to you. Essentially, this is a form of forced savings through real estate.

Think of paying the principal on your mortgage like putting money in a bank. It's your money, building up over time as you pay off your home. If you decide to sell your house, you get this money back because it's what you've paid towards the actual cost of your home.

Profits

Profits are the cash gains received from selling your property. It is different from property appreciation. This is because many of us use CPF (Central Provident Fund) for property payments. When using CPF, you must repay the principal and the "accrued interest" — the interest your CPF funds could have earned if not used for housing. Some owners face a "negative sale," where the accrued interest surpasses the property's market appreciation, often due to holding the property too long.

Personal Savings

I recommend having an emergency fund equivalent to 3-6 months of your income. This is crucial for covering unexpected costs during the transaction process, which can take about 4-5 months.

This is just in case something unexpected happens, like a sudden job loss or a big repair. There are extra costs like repairs being ordered by property inspectors, closure of town council/ MCST account and property tax.

Conclusion

Upgrading your home is a journey filled with excitement and, admittedly, a fair share of decision-making. By walking through the 5 Ps - Promotion, Property Appreciation, Property Savings, Profits, and Personal Savings - this can contribute to a well-informed decision about moving on to your next dream home.

Remember, upgrading isn't just about seizing an opportunity because it's there; it's about making sure that opportunity aligns with your current circumstances and future goals. It's about considering the stability of your increased income, understanding how much your current home has grown in value, recognizing the equity you've built up, calculating the real profit after all dues are cleared, and ensuring you have a safety net of savings for the unexpected.

For a more in-depth consultation, feel free to get in touch here.

Testimonial

“Andik was extremely helpful, open, transparent, and reliable through the whole process. He really cared about us, understood our needs from the very first meeting. He was always available to answer our questions too. He is an excellent negotiator with a very personalized touch. Highly recommended!”